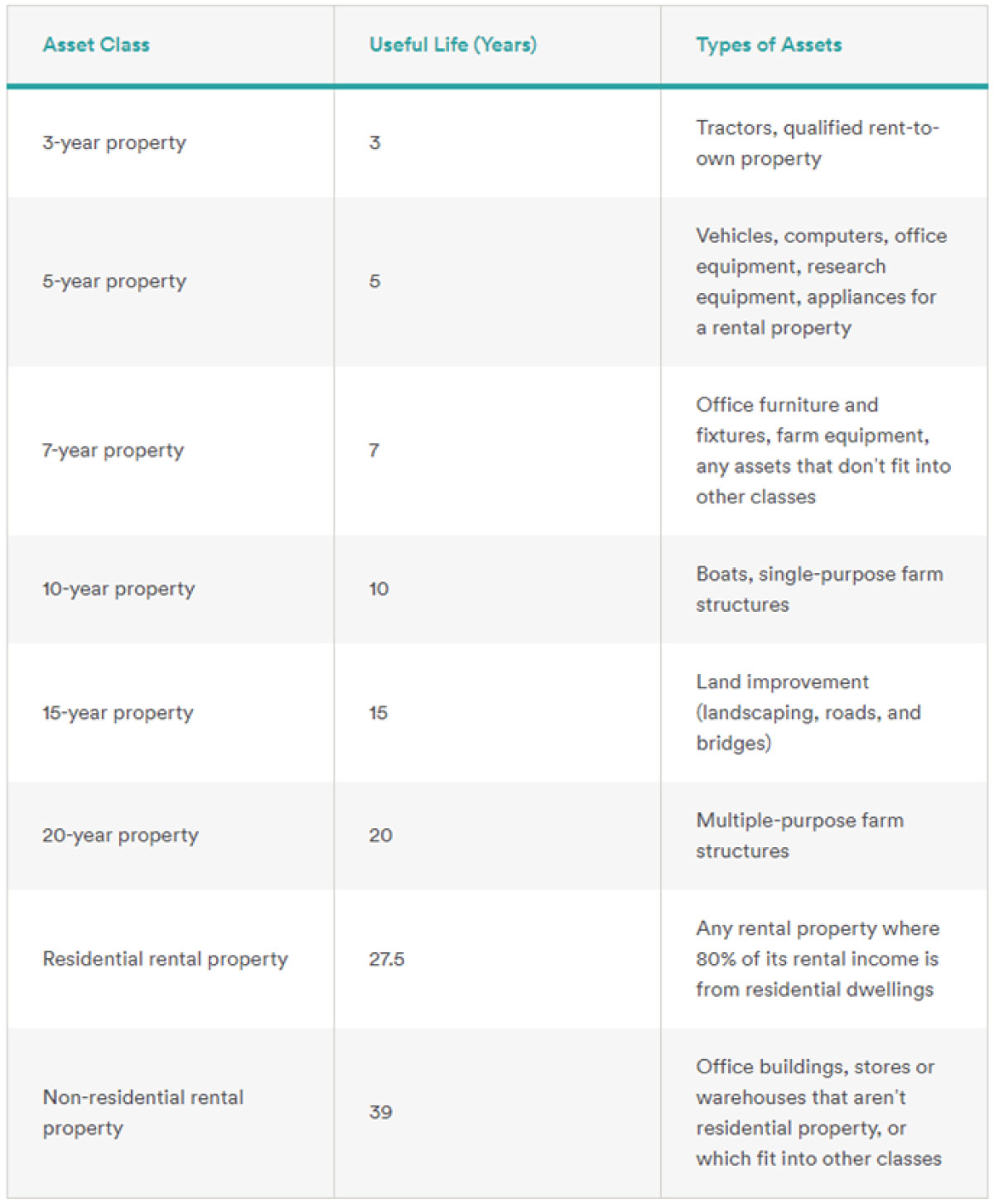

What Is The Useful Life Of A Building . The irs provides standard useful lifespans for various. learn how to determine the useful life of an asset for tax and gaap purposes, with guidance from irs publication 946 and asc 350. the useful life of a fixed asset represents the period over which the asset is expected to contribute value to the business operations. this guideline is a general guide for determining the useful life of building elements for considering applications for. Introduction to building depreciation and useful life. learn how to determine the useful life of tangible and intangible assets, which is the period over which they. learn what a tangible asset is and how to estimate its useful life for tax purposes. learn what useful life of an asset is, how it affects depreciation and financial planning, and how to estimate it based on various factors.

from limblecmms.com

this guideline is a general guide for determining the useful life of building elements for considering applications for. learn what a tangible asset is and how to estimate its useful life for tax purposes. the useful life of a fixed asset represents the period over which the asset is expected to contribute value to the business operations. Introduction to building depreciation and useful life. learn how to determine the useful life of an asset for tax and gaap purposes, with guidance from irs publication 946 and asc 350. learn how to determine the useful life of tangible and intangible assets, which is the period over which they. The irs provides standard useful lifespans for various. learn what useful life of an asset is, how it affects depreciation and financial planning, and how to estimate it based on various factors.

Determining the Useful Life of Assets and 5 Ways to Extend it

What Is The Useful Life Of A Building learn what a tangible asset is and how to estimate its useful life for tax purposes. the useful life of a fixed asset represents the period over which the asset is expected to contribute value to the business operations. Introduction to building depreciation and useful life. learn how to determine the useful life of tangible and intangible assets, which is the period over which they. learn what a tangible asset is and how to estimate its useful life for tax purposes. learn what useful life of an asset is, how it affects depreciation and financial planning, and how to estimate it based on various factors. The irs provides standard useful lifespans for various. this guideline is a general guide for determining the useful life of building elements for considering applications for. learn how to determine the useful life of an asset for tax and gaap purposes, with guidance from irs publication 946 and asc 350.

From elchoroukhost.net

Us Gaap Fixed Asset Useful Life Table Elcho Table What Is The Useful Life Of A Building Introduction to building depreciation and useful life. learn what useful life of an asset is, how it affects depreciation and financial planning, and how to estimate it based on various factors. learn what a tangible asset is and how to estimate its useful life for tax purposes. learn how to determine the useful life of tangible and. What Is The Useful Life Of A Building.

From www.youtube.com

What Happens Over the Life of a Building..? YouTube What Is The Useful Life Of A Building learn what useful life of an asset is, how it affects depreciation and financial planning, and how to estimate it based on various factors. learn how to determine the useful life of tangible and intangible assets, which is the period over which they. Introduction to building depreciation and useful life. this guideline is a general guide for. What Is The Useful Life Of A Building.

From studylib.net

Estimated Useful Life (EUL) Tables What Is The Useful Life Of A Building this guideline is a general guide for determining the useful life of building elements for considering applications for. learn how to determine the useful life of tangible and intangible assets, which is the period over which they. the useful life of a fixed asset represents the period over which the asset is expected to contribute value to. What Is The Useful Life Of A Building.

From imaginearchitecture.blogspot.com

MAKING YOUR BUILDING SUSTAINABLE (Green) ARCHITECTS BLOG What Is The Useful Life Of A Building The irs provides standard useful lifespans for various. the useful life of a fixed asset represents the period over which the asset is expected to contribute value to the business operations. learn what a tangible asset is and how to estimate its useful life for tax purposes. learn how to determine the useful life of tangible and. What Is The Useful Life Of A Building.

From www.slideserve.com

PPT Topic 4 Life Cycle Costing PowerPoint Presentation, free download ID5050257 What Is The Useful Life Of A Building learn what useful life of an asset is, how it affects depreciation and financial planning, and how to estimate it based on various factors. this guideline is a general guide for determining the useful life of building elements for considering applications for. The irs provides standard useful lifespans for various. learn how to determine the useful life. What Is The Useful Life Of A Building.

From www.epstengroup.com

LifeCycle Assessment of a Building Epsten Group What Is The Useful Life Of A Building the useful life of a fixed asset represents the period over which the asset is expected to contribute value to the business operations. learn how to determine the useful life of tangible and intangible assets, which is the period over which they. Introduction to building depreciation and useful life. learn what a tangible asset is and how. What Is The Useful Life Of A Building.

From www.researchgate.net

Estimated Useful Lives of Building Components in Life cycle Cost... Download Table What Is The Useful Life Of A Building The irs provides standard useful lifespans for various. learn how to determine the useful life of tangible and intangible assets, which is the period over which they. the useful life of a fixed asset represents the period over which the asset is expected to contribute value to the business operations. learn what useful life of an asset. What Is The Useful Life Of A Building.

From www.chegg.com

Solved a. The buildings have an estimated useful life of What Is The Useful Life Of A Building The irs provides standard useful lifespans for various. the useful life of a fixed asset represents the period over which the asset is expected to contribute value to the business operations. learn what useful life of an asset is, how it affects depreciation and financial planning, and how to estimate it based on various factors. learn how. What Is The Useful Life Of A Building.

From www.chegg.com

Solved Revision of Depreciation A building with a cost of What Is The Useful Life Of A Building The irs provides standard useful lifespans for various. learn what useful life of an asset is, how it affects depreciation and financial planning, and how to estimate it based on various factors. the useful life of a fixed asset represents the period over which the asset is expected to contribute value to the business operations. this guideline. What Is The Useful Life Of A Building.

From www.slideshare.net

LIFE OF BUILDING What Is The Useful Life Of A Building learn what useful life of an asset is, how it affects depreciation and financial planning, and how to estimate it based on various factors. the useful life of a fixed asset represents the period over which the asset is expected to contribute value to the business operations. learn how to determine the useful life of an asset. What Is The Useful Life Of A Building.

From www.chegg.com

Solved A building is acquired on January 1, at a cost of What Is The Useful Life Of A Building learn what useful life of an asset is, how it affects depreciation and financial planning, and how to estimate it based on various factors. The irs provides standard useful lifespans for various. learn how to determine the useful life of tangible and intangible assets, which is the period over which they. Introduction to building depreciation and useful life.. What Is The Useful Life Of A Building.

From www.udg.org.uk

Life Between Buildings Using Public Space Urban Design Library Urban Design Group What Is The Useful Life Of A Building learn how to determine the useful life of tangible and intangible assets, which is the period over which they. the useful life of a fixed asset represents the period over which the asset is expected to contribute value to the business operations. Introduction to building depreciation and useful life. learn how to determine the useful life of. What Is The Useful Life Of A Building.

From dxorzcdfs.blob.core.windows.net

Useful Life Of Equipment For Depreciation at Stephen Curtis blog What Is The Useful Life Of A Building learn what useful life of an asset is, how it affects depreciation and financial planning, and how to estimate it based on various factors. Introduction to building depreciation and useful life. learn what a tangible asset is and how to estimate its useful life for tax purposes. this guideline is a general guide for determining the useful. What Is The Useful Life Of A Building.

From www.slideshare.net

LIFE OF BUILDING What Is The Useful Life Of A Building learn what useful life of an asset is, how it affects depreciation and financial planning, and how to estimate it based on various factors. the useful life of a fixed asset represents the period over which the asset is expected to contribute value to the business operations. this guideline is a general guide for determining the useful. What Is The Useful Life Of A Building.

From www.archdaily.com

Understanding Whole Building Life Cycle Assessment for a Better Architecture ArchDaily What Is The Useful Life Of A Building The irs provides standard useful lifespans for various. the useful life of a fixed asset represents the period over which the asset is expected to contribute value to the business operations. learn how to determine the useful life of an asset for tax and gaap purposes, with guidance from irs publication 946 and asc 350. learn what. What Is The Useful Life Of A Building.

From limblecmms.com

Determining the Useful Life of Assets and 5 Ways to Extend it What Is The Useful Life Of A Building learn how to determine the useful life of tangible and intangible assets, which is the period over which they. learn what useful life of an asset is, how it affects depreciation and financial planning, and how to estimate it based on various factors. this guideline is a general guide for determining the useful life of building elements. What Is The Useful Life Of A Building.

From www.researchgate.net

Design life of buildings by category. Download Table What Is The Useful Life Of A Building the useful life of a fixed asset represents the period over which the asset is expected to contribute value to the business operations. learn how to determine the useful life of tangible and intangible assets, which is the period over which they. Introduction to building depreciation and useful life. learn what useful life of an asset is,. What Is The Useful Life Of A Building.

From buildipedia.com

The Daily Life of Building Information Modeling (BIM) Buildipedia What Is The Useful Life Of A Building learn what useful life of an asset is, how it affects depreciation and financial planning, and how to estimate it based on various factors. The irs provides standard useful lifespans for various. Introduction to building depreciation and useful life. the useful life of a fixed asset represents the period over which the asset is expected to contribute value. What Is The Useful Life Of A Building.